15/09/2023

IL BONUS PER L'INSTALLAZIONE DI COLONNINE ELETTRICHE

- 522 Visite

La transizione ecologica rappresenta uno dei principali vettori dello sviluppo economico sostenibile, obiettivo dell'Agenda 2030 approvata il 25 settembre 2015 dall'Assemblea generale delle Nazioni Un...

05/06/2022

LA CESSIONE DEL CREDITO NEI BONUS EDILIZI

- 654 Visite

Il decreto rilancio (art. 121) accorda la possibilità di esercitare le opzioni dello sconto in fattura e della cessione del credito ai soggetti che nel 2020, 2021, 2022, 2023 e 2024 hanno sostenuto sp...

15/07/2022

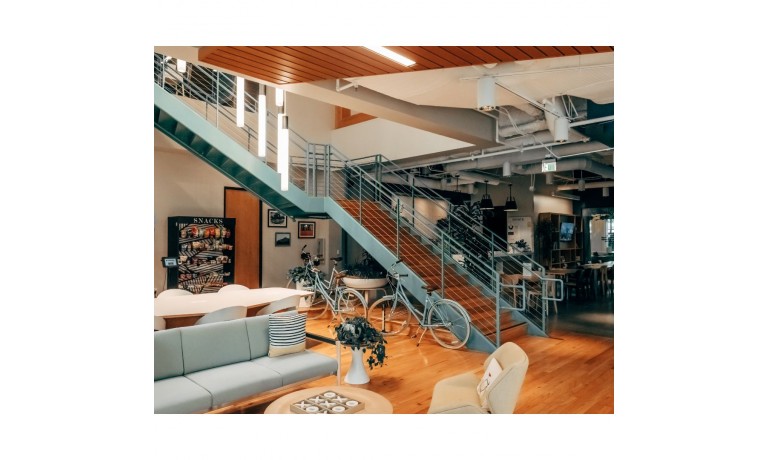

COME INVESTIRE NEL REAL ESTATE CON IL BONUS ACQUISTI

- 670 Visite

Il bonus acquisti è un’agevolazione fiscale pensata per l’acquirente di unità immobiliari siti in edifici oggetto di ristrutturazione o riqualificazione energetica.

A differenza degli altri bonus edi...

03/06/2022

VUOI ANDARE A VIVERE DA SOLO? ECCO LE AGEVOLAZIONI PER L’ACQUISTO DELLA PRIMA CASA

- 676 Visite

Cosa sono le agevolazioni “prima casa”?

Le agevolazioni “prima casa” consentono all’acquirente di ottenere una riduzione delle imposte da versare per l’acquisto dell’unità immobiliare acquistata come...